Kenya is not at risk of a debt default and has crafted a clear debt repayment schedule with local and international creditors.

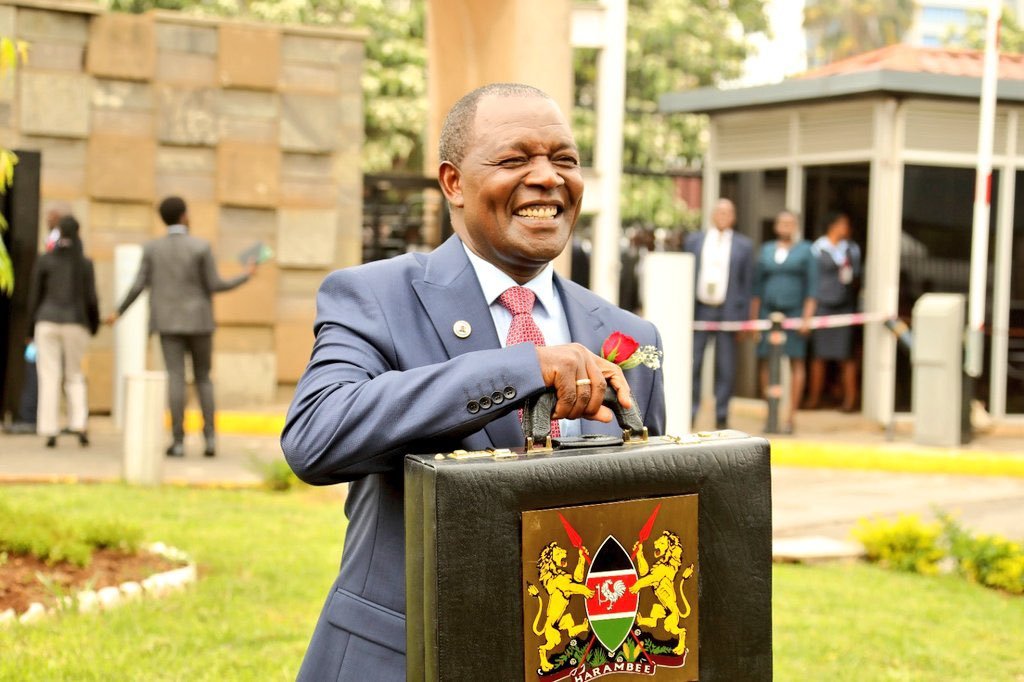

Treasury Cabinet Secretary Prof. Njuguna Ndung’u told the National Assembly that Kenya’s public debt, which hit Ksh 10.19 trillion by close of June 2023 remains feasible despite worsening global macroeconomic conditions.

For every Ksh 10 earned from income tax, Kenya is spending Ksh 6 on service debt, affecting development expenditure.

In the last financial year alone, the National Government borrowed a total of Ksh 985.7 billion in order to plug the Ksh 800.4 billion in budget deficit.

Prof. Ndung’u told legislators that the ongoing fiscal pressure will ease once economic growth ticks and balance of payment accounts improves.

MPs also demanded to know measures the government has put in place to stabilize the weakening Kenya shilling against the dollar.

The CS told Parliament that the depreciation of the Kenya shillings has increased the size of the public debt stock as half of the public debt is commercial and syndicated loans denominated in foreign currency.

The CS was also put to task by members over the recruitment of the 1,405 revenue service assistants by the Kenya Revenue Authority.

The MPs questioned why the officers had to undergo paramilitary training bearing in mind that tax payment is a civic duty of all qualified Kenyans.

The MPs also directed the National Treasury to ensure funds meant to pay retired teachers dating back to more than two decades is not diverted to other users.