A new law that will spur investment and accelerate legal use of digital assets in Kenya is underway following submission of the draft document by the Blockchain Association of Kenya (BAK) to the National Assembly.

The lobby group which was mandate to propose a bill for consideration by the Finance and National Planning Committee says the Virtual Assets Service Providers Bill 2024 if passed into law, will help the country set out clear rules of trading digital assets as well as net additional taxes through capital gains.

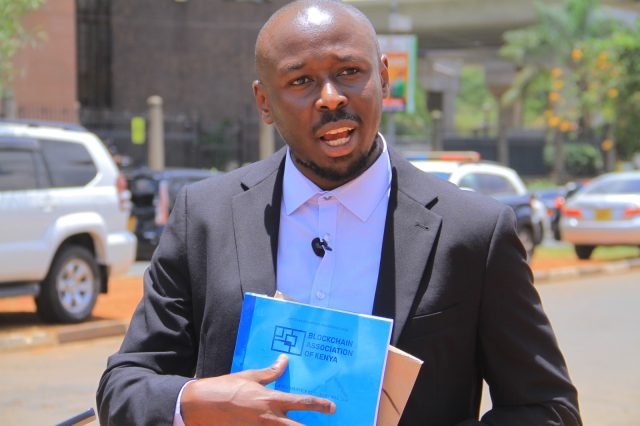

While submitting the document to the committee on Monday, BAK Chairman Michael Kimani said Kenya has been struggling a lot with consumer protection issues around cryptocurrency while at the same time, entities seeking to establish commercial operations around blockchain technology such as WorldCoin have been met with resistance from authorities.

Lack of regulations has been cited as one of the biggest contributors to the rise in cryptocurrency related frauds that have seen Kenyans lose millions of shillings to online scammers.

“There was a clear vacuum in having a framework that can help businesses find a way to come to this country a framework that can help young people who want to innovate with the technology and a framework that can protect consumers interested in digital assets, but because there are no formal ways for businesses to get set up, they end up getting scammed or getting into fraudulent schemes,” said Kimani.

The VASP Bill also identifies who the regulator of the digital assets will be. While the Capital Markets Authority (CMA) has been propped to be the regulator, BAK says regulation of the industry which traverses various sectors such as finance and technology will still require collaboration with other agencies.

“The bill also talks about a regulatory sandbox whereby if you are a businesses and you are trying to set up a digital assets business in this country, you can come through a sandbox and have your innovation approved,” added Kimani.

Crypto related frauds continue to rise worldwide as various governments rush in to ensure consumer protection and curtail money laundering and other illicit financial flows.

“Without robust safeguards, the increased risk of fraud and misconduct could adversely impact investors’ expected returns,” said the International Monetary Fund (IMF) in July last year.

A research by Comparitech found out that the total monetary value of cryptocurrency theft reached $1.75 billion last year from $3.55 billion a year earlier.

BAK further backs adoption of the bill to help the country attract investments and expand job opportunities for young people.

“The bill is also about opening up Kenya as a commercial digital asset for companies to come and set up,” noted Kimani.