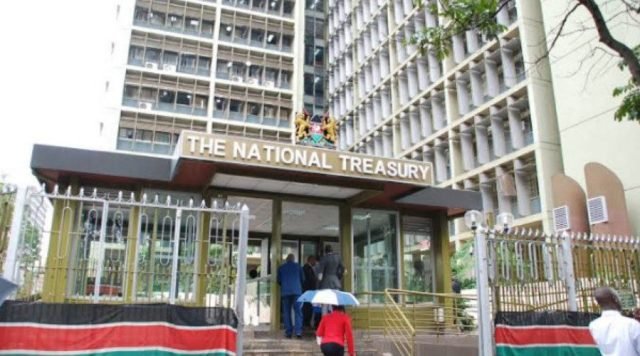

The National Treasury is exploring a series of reforms aimed at boosting national savings and encourage investments in the capital markets.

According to National Treasury and Economic Planning Cabinet Secretary John Mbadi, there is need for pension schemes to diversify their portfolios and explore new investment avenues beyond traditional assets.

While Kenya’s savings culture has shown improvement, it remains relatively low at around 10pc of GDP, lagging behind neighbouring countries like Uganda and Tanzania.

Pension schemes in Kenya have traditionally invested in low risk assets such as government securities as well as equities. Now, the government is encouraging the pension schemes to shift away from traditional assets like land and embrace more value-added, sustainable investment models.

Mbadi is emphasizing the need to reforms the capital markets to foster a stronger savings culture. He highlighted infrastructure development as a promising investment avenue for pension funds.

Mbadi said by channelling more pension savings into capital markets, Kenya could achieve substantial economic growth, improve individual retirement savings, and reduce dependency on government support in retirement.

He further added that the Nairobi International Financial Centre is key in making Kenya a more attractive destination for financial services and investment.